Fractional CFO vs. Controller vs. Accountant: Decoding Strategic Financial Leadership for Your Business

Section 1: Introduction - Navigating the Labyrinth of Financial Roles

Is your business unknowingly stalling growth due to a financial team mismatch?

As a business leader, you navigate a labyrinth of financial roles: Accountant, Controller, Fractional CFO. The titles often blur, and the confusion is common. But choosing the wrong expertise for your company's stage can be a costly mistake, creating a drag on performance just when you should be accelerating.

This guide is your map. We will deconstruct the complex topic of Fractional CFO vs. Controller vs. Accountant, providing a clear, experience-backed breakdown of each role. By understanding the unique responsibilities and strategic value of each professional, you can make an informed decision that aligns with your business stage and fuels your ambition. Choosing the right financial partner isn't just an operational task; it's a strategic imperative for sustainable growth.

1.1 The Foundation - What Does an Accountant Do?

Every successful business is built on a solid financial foundation. This essential groundwork is the domain of the Accountant.

Think of an accountant as your financial historian. Their primary focus is on the past, ensuring every transaction is accurately recorded and compliant. They organize your data, ensure you meet legal requirements, and create a clear, documented record of your company's financial history.

Key Responsibilities:

Bookkeeping and Transaction Recording: Accurately logging all financial transactions, from sales invoices to expense receipts. This is the core difference in the bookkeeper vs. accountant dynamic, where accountants often oversee or refine bookkeeping data.

Payroll Processing: Ensuring employees are paid correctly and on time, including tax withholdings.

Tax Preparation and Compliance: Preparing and filing federal, state, and local tax returns to ensure the business meets all its legal obligations.

Financial Statement Compilation: Assembling historical reports like the Profit & Loss (P&L) statement, Balance Sheet, and Statement of Cash Flows.

Qualifications: Accountants typically hold a bachelor's degree in accounting. Many are Certified Public Accountants (CPAs), a credential that requires rigorous examination and adherence to professional standards set by bodies like the American Institute of CPAs (AICPA).

When Your Business Needs One: An accountant is essential from day one. Startups and small businesses rely on them for fundamental record-keeping, basic financial reporting, and critical tax compliance. They bring order to your financial chaos and ensure you have a clean, accurate record of your business's history.

1.2 Stepping Up - The Role of a Financial Controller

As your business grows, its financial complexity multiplies. You're no longer just recording the past; you need someone to manage the present. This is where a Financial Controller steps in. A Controller builds upon the accountant's work, using historical data to manage current operations and establish financial discipline.

If the accountant is the historian, the Controller is the manager, overseeing the entire accounting function to ensure accuracy, efficiency, and control.

Key Responsibilities:

Overseeing Accounting Operations: Managing the accounting team, month-end close processes, and the general ledger.

Ensuring Financial Reporting Accuracy: Verifying the integrity of financial statements before they are presented to management.

Developing and Managing Internal Controls: Creating processes to prevent fraud, reduce errors, and ensure the security of company assets.

Budgeting and Cash Flow Management: Leading the annual budgeting process and monitoring day-to-day cash flow management to ensure operational stability.

Process Improvement: Identifying and implementing more efficient ways to handle financial operations.

Qualifications: A Controller typically has a bachelor's or master's degree in accounting or finance, often holds a CPA, and has several years of experience managing an accounting department. The CFO vs. Controller roles are distinct; a Controller is focused inward on operational excellence, while a CFO is focused outward and forward on strategy.

When Your Business Needs One: Your business needs a Controller when you have multiple team members in your accounting department, your transaction volume has become significant, or you feel a lack of control over your internal financial processes. They bring the discipline and oversight needed to manage a growing, complex organization.

1.3 Strategic Command - Understanding the Fractional CFO

When your focus shifts from managing the present to actively architecting the future, you've reached the need for a Chief Financial Officer (CFO). For most small and mid-sized businesses, the cost of a full-time, executive-caliber CFO is prohibitive. This is where the Fractional CFO becomes a game-changer.

A Fractional CFO is a strategic partner who provides executive-level financial leadership on a part-time or project basis. They are not concerned with recording the past or managing the present; they are focused on interpreting data to shape your company's future and drive value creation. This is the pinnacle of strategic finance roles.

Key Responsibilities:

Strategic Financial Planning and Forecasting: Building financial models that map out the company's future and guide strategic decisions.

Capital Allocation and Fundraising: Determining the best use of capital and leading efforts to secure funding from investors or lenders.

Profitability Analysis and Pricing Strategy: Diving deep into the drivers of profitability to optimize pricing, reduce costs, and improve margins.

Risk Management: Identifying financial risks and developing strategies to mitigate them.

Investor Relations and M&A Support: Acting as the financial liaison to the board, investors, and supporting any merger or acquisition activities.

High-Level Financial Advisory: Serving as a strategic sounding board to the CEO and leadership team.

Qualifications: A true strategic Fractional CFO possesses more than just accounting knowledge. They often have an MBA from a top-tier institution (like Toro CFO founder Richard Rosado's from Cornell University), combined with decades of executive-level experience at major corporations, such as a Fortune 100 company.

As Richard Rosado, Founder of Toro CFO, puts it:

"At Toro CFO, we don't just manage numbers; we architect financial futures. Our bespoke approach, forged from decades of Fortune 100 strategic leadership, ensures every client receives clarity, precision, and the insights necessary to unlock their unique growth potential."

When Your Business Needs One: You need a Fractional CFO when you're preparing for significant growth, seeking outside investment, considering an acquisition, or when you feel that your current financial data isn't providing the financial insights you need to make high-stakes decisions.

Section 2: The "Fractional" Advantage: High-Impact, Flexible Expertise

The fractional model provides a powerful advantage. It grants SMBs access to the kind of elite, strategic talent typically reserved for large corporations, but without the burden of a full-time executive salary and benefits. This cost-effective leadership is a core benefit of an outsourced CFO. With a firm like Toro CFO, this isn't about generic advice; it's a "low-volume, high-value" bespoke approach. You get a dedicated partner who provides a flexible financial strategy tailored specifically to your business goals.

2.1 Side-by-Side: A Direct Comparison of Responsibilities and Impact

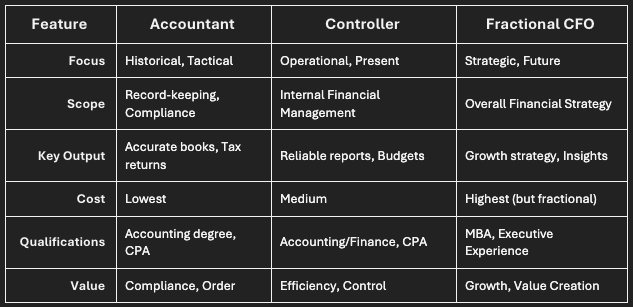

To bring these financial roles explained into sharp focus, here is a direct comparison:

Financial Roles Table

This table clarifies the debate of fractional cfo vs accountant and highlights the key differences in cfo vs controller roles.

Section 3: Do You Need a CFO or Controller? Aligning Financial Talent with Your Business Stage

The right answer depends entirely on your current challenges and future goals. Here’s a simple framework to guide your decision-making.

Early Stage / Small Business: Your primary need is compliance and accurate record-keeping. An Accountant is your essential first hire.

Growth Stage / Mid-Sized Business: Your operations are becoming complex. You need process, control, and reliable reporting. A Controller is necessary to build a scalable financial infrastructure.

Rapid Growth / Strategic Inflection Point: You're looking to scale aggressively, raise capital, or navigate a complex transaction. Your need is for forward-looking strategy and executive guidance. A Fractional CFO is the strategic partner you need to unlock that potential.

3.1 Self-Assessment Questions for Business Leaders

Ask yourself these questions to identify your current financial leadership gap:

Are your financial reports telling you what happened, but not why it happened or what to do next?

Are you planning to seek outside investment, apply for a significant loan, or sell your business in the next 1-3 years?

Do you lack a clear financial model that connects your strategic goals to measurable financial outcomes?

Are you struggling with complex decisions around pricing, profitability by product/service, or capital allocation?

Does your leadership team lack a high-level financial expert to act as a strategic partner and sounding board?

If you answered "yes" to two or more of these questions, you are likely feeling the absence of strategic financial leadership and would benefit from a Fractional CFO.

Section 4: Why Strategic Financial Leadership is Non-Negotiable for Growth

As highlighted in publications like Harvard Business Review, a company's ability to execute its strategy is inextricably linked to its financial acumen. Simply having clean books is not enough to win in a competitive market. You need strategic financial leadership to translate your vision into a viable, funded, and profitable reality.

Without this forward-looking guidance, businesses often fall into common traps: running out of cash despite being "profitable," misallocating resources to low-margin activities, or failing to secure the capital needed to fund growth. A Fractional CFO acts as a safeguard against these risks, providing the clarity, stability, and data-driven insights necessary to make confident decisions and unlock your company's full potential.

Section 5: Conclusion & Your Next Strategic Move

Understanding the difference between an Accountant, a Controller, and a Fractional CFO is more than an academic exercise—it's fundamental to building a resilient, high-growth business. An Accountant provides the foundation of order. A Controller builds the structure of control. But a Fractional CFO provides the strategic vision to build the future.

By aligning the right financial expertise with your business goals, you transform your finance function from a cost center into a strategic catalyst for growth. You move from simply reporting on the past to actively shaping the future.

If you're ready to move beyond historical reporting and embrace forward-looking financial strategy, it's time to explore a partnership that can illuminate the path ahead.

Ready for Elite Financial Insight? Schedule a Discovery Call with Toro CFO Today.